Direct lenders, regional lenders, and online lenders are 3 prospective sources which provide personal loans for terrible credit. Just remember that you'll likely spend a better curiosity fee than for those who experienced greater credit score. Electronic lending networks allow you to compare online personal loans for undesirable credit from several lenders with one particular loan application, when immediate lenders are the standard banking institutions and credit unions handling the loans.

Get unlimited free credit scores & reports Enroll in no cost credit checking Get the cost-free credit score & report

Whilst you don't danger losing an asset, the lender assumes much more danger If you don't repay That which you borrow. Subsequently, flex loans generally come with bigger yearly share rates (APRs).

With an open up line of credit, you are able to carry on to borrow up in your credit limit as wanted. Most often, you will pay more than your required minimum month to month payment with none penalties to pay for the personal debt off faster.

What exactly is Scholar Loan Forgiveness? Student loan forgiveness can be a launch from being forced to repay the borrowed sum, in full or in part. You can find now numerous solutions to achieve university student loan forgiveness for federal student loans.

Metrics with greater precedence, which include APRs and approval standards, were assigned bigger weights than Other folks.

Contrary to several of the other lenders on our list, LendingPoint doesn’t let co-signers or joint applications, however it has somewhat reduced necessities for income and credit, and it disburses money once the next day right after approval.

It really is a method to borrow dollars to buy absolutely anything you'll need, like residence enhancements, credit card debt consolidation, big buys, plus more. Personal loans are unsecured, meaning there is not any collateral, such as fairness you own in your automobile or house.

Emergency loans are personal loans that you could get within a couple small business days to buy unforeseen expenditures such as healthcare facility payments, auto repairs or repairing storm harm. They can offer nearly $one hundred,000 in funding, small minimum APRs and prolonged repayment periods.

Co-signer or co-applicant principles: A co-signer will make it easier to qualify to get a loan or enable you to get a much better curiosity price, but not all lenders allow them. If you're thinking that you’ll need a co-signer, Restrict your search to lenders that let them.

A lot of these loans offer quick funding and have minimum needs, so that they're easy to have even for individuals with undesirable credit.

A pawnshop will Examine a personal product that you choose to usher in as Find out more collateral and loan you a share of its benefit. Pawnshop loans give instant cash but can sell your property if you are unsuccessful to repay the loan.

Precisely what is a Flex Loan? Flex loans absolutely are a line of credit that borrowers can use to get access to cash. The lender sets a credit limit, and you can borrow around that amount, very similar to you would probably having a credit card. Helpful hints You will pay interest on the money you borrow, usually at comparatively large curiosity rates.

Quick application process. You'll be able to usually apply for and receive a flex loan inside Informative post of a shorter length of time, likely even the exact same working day.

Andrea Barber Then & Now!

Andrea Barber Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Katey Sagal Then & Now!

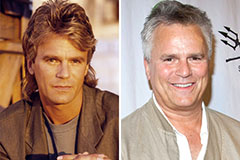

Katey Sagal Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!